what nanny taxes do i pay

There are a few of them that pop up. Remember an independent contractor sets their own rate of pay hours and working.

Can I Deduct Nanny Expenses On My Tax Return Taxhub

A nanny tax is a federally required tax paid by people who employ household employees and pay wages over a certain threshold.

. Before you dive in its a good. Attach Form 2441 with your personal. Paying a nanny is a personal expense not a business expense.

Additional requirements may apply for individual. FICA taxes are Social Security and Medicare contributions and they are split. In that case youll need to withhold and pay Social Security and Medicare taxes which are 153 of the employees wages.

The 2022 nanny tax threshold is 2400 which means if a. Who pays the nanny tax. Calculate payroll each pay period.

Calculate social security and Medicare taxes. Wages you pay your nanny and possibly an in-home senior caregiver are qualified expenses for the Child and Dependent Care Tax Credit. I am a nanny how do I pay my taxes.

You DO need to pay nanny. Your business can deduct ordinary and necessary expenses of running the business. So while you could.

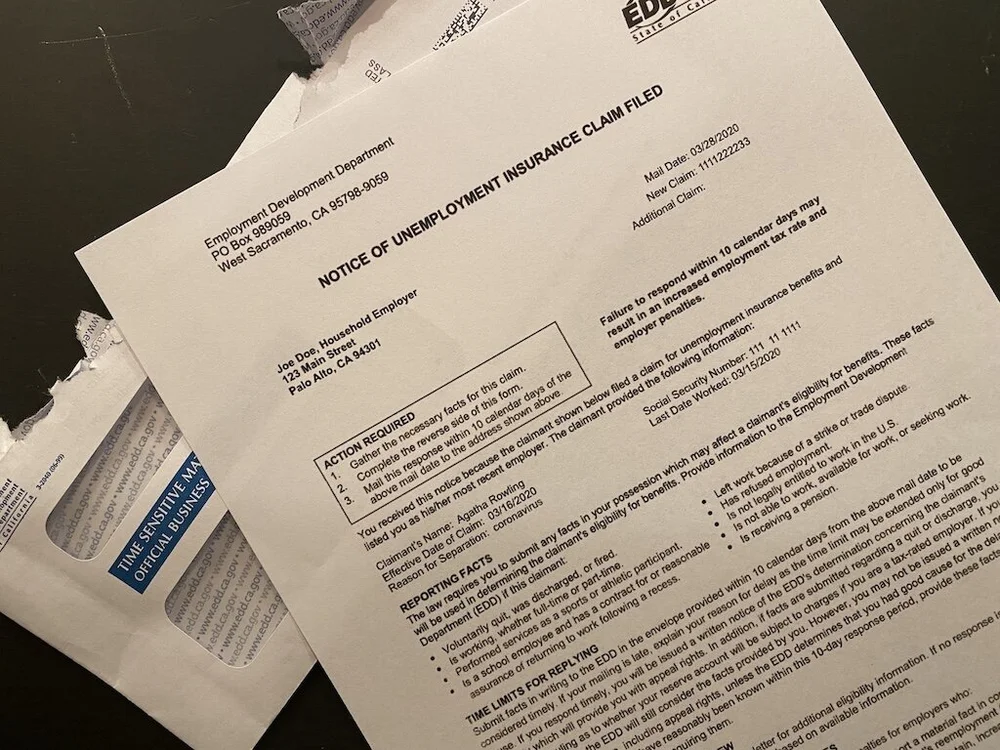

Send taxes to the IRS and state throughout the year. If you pay your nanny 2200 in one calendar year you are required to pay FICA taxes. Your total cost from an employer perspective will be 8-10 of the nannys salary for the nanny tax depending on your state and the total wages you pay.

Like other employers parents must pay certain taxes. Prepare year-end tax documents. This form will show your wages and any taxes withheld.

You can then pay the IRS. Anyone who hires an employee needs to pay payroll taxes. If your nanny is a W-2 employee.

The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes. For the 2022 tax year nanny taxes come into play when a family pays any household employee 2400 or more in a calendar year or 1000 or more in a calendar quarter for unemployment.

You the employer pay 765 percent or 7650 and the rest 5650 is withheld from the nannies wages. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for. You and your employee each pay 765 percent of gross.

If your nanny is a household employee you will typically have to pay nanny taxes. In the vast majority of states it will. This is the gross wage.

The taxes that need to be paid on the 1000 would be 133. These taxes include social security and Medicare taxes FICA and Federal Unemployment. The families that hire them are responsible for paying payroll taxes and unemployment insurance taxes but nannies who are hired as employees must pay income tax.

Complete the required setup paperwork. Your employer is required to give you a form W2 by January 31st. You will use this form to file your.

Employers and employees pay an equal. Multiply the number of hours by the hourly wage. Nanny taxes are the federal and state taxes families pay as well as withhold from a household employee if they earn 2400 or more during the 2022 year.

Helping You Pay Your Nanny Taxes Legally

Do I Need To Pay Taxes For My Nanny

Does The Household Employee Tax Apply To Me And What To Do Mark J Kohler

Does My Nanny Have To Pay Taxes

How To Do Your Nanny Taxes The Right Way Marin Mommies

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Taxes Explained Tl Dr Accounting

Nanny Taxes Nanny In Los Angeles Riveter Consulting Group

Paycheck Nanny Guided Diy Nanny Paycheck And Tax App

Catch Up On The Nanny Tax Nest Payroll

Nanny Pay Taxes Saint Paul Minnesota Tent Group

:max_bytes(150000):strip_icc()/hire-a-nanny-58e10a823df78c516250c87c.jpg)

What To Know About Household Employee Taxes

Guide To Paying Nanny Taxes In 2022

More Nanny Taxes What To Do If They Accidentally Give You A 1099 Youtube

The Nanny Tax How Does It Work Inside Indiana Business